Welcome to our blog post on how to design your investment for a car loan. At Sydney Car Loans, we understand the significance of strategic investment planning when it comes to financing your dream car. By carefully considering your options and tailoring your investment strategy, you can make the most of your car loan and achieve your automotive goals.

Investing in a car loan offers several benefits. Firstly, it allows you to spread the cost of your vehicle over a period of time, making it more affordable and manageable. Secondly, by choosing the right car loan and investment strategy, you can potentially maximize your returns and save money in the long run. Lastly, designing your investment plan ensures that you make informed decisions based on your financial goals and risk tolerance.

Stay tuned for the upcoming sections where we will delve deeper into the factors to consider when designing your car loan investment, explore different investment options, provide tips on maximizing returns, and discuss the importance of personalizing your investment strategy. We will also address frequently asked questions to address any concerns you may have.

Explore All Our Car Financing Options

Factors to Consider When Designing Your Car Loan Investment

When it comes to designing your car loan investment, there are several important factors to consider. By carefully evaluating these factors, you can make informed decisions that align with your financial goals and risk tolerance. Let's explore some key considerations:

Understanding Your Financial Goals and Risk Tolerance

Before diving into the car loan investment process, it's crucial to have a clear understanding of your financial goals. Are you looking for short-term gains or long-term returns? Do you have specific financial milestones you want to achieve? By defining your objectives, you can tailor your investment strategy accordingly.

Additionally, assessing your risk tolerance is essential. Some individuals may be comfortable with higher-risk investments in pursuit of potentially higher returns, while others prefer more conservative options. Understanding your risk tolerance will help you select a car loan investment that aligns with your comfort level.

Significance of Interest Rates and Loan Terms

Interest rates and loan terms play a significant role in designing your car loan investment. The interest rate determines the cost of borrowing and affects the overall affordability of the loan. It's essential to compare interest rates from different lenders to secure the most competitive rate.

Loan terms, on the other hand, refer to the duration of the loan. Shorter loan terms may result in higher monthly payments but can save you money in interest over the long run. Longer loan terms may offer lower monthly payments but may result in higher overall interest payments. Consider your financial situation and future plans to determine the loan term that suits you best.

Role of Credit Score and Eligibility Criteria

Your credit score plays a crucial role in securing a car loan and designing your investment plan. Lenders assess your creditworthiness based on your credit score, which reflects your credit history and ability to repay debts. A higher credit score can qualify you for better interest rates and loan terms.

Understanding the eligibility criteria set by lenders is also vital. Different lenders may have varying criteria regarding income, employment history, and debt-to-income ratio. By familiarizing yourself with these criteria, you can determine which lenders are more likely to approve your loan application and design your investment plan accordingly.

At Sydney Car Loans, we can guide you through the process of understanding these factors and help you make informed decisions. Our team of experts can assess your financial goals, risk tolerance, and credit profile to recommend suitable car loan investment options in Sydney. We have access to a wide range of car finance options, allowing us to find the right solution for you.

Stay tuned for the upcoming sections where we will explore the different investment options for car loans, provide tips on maximizing returns, and discuss the importance of personalizing your investment strategy.

Remember, designing your car loan investment is a crucial step towards achieving your automotive dreams. Let Sydney Car Loans be your trusted partner in this journey, providing you with personalized loan solutions and expert guidance.

Explore Our Business Car Loans

The Different Investment Options for Car Loans

When it comes to car loan investments, there are various options available in Sydney. Each option has its own set of advantages and considerations. Let's explore some of the different investment options you can consider:

Business Car Loans

A business car loan is an excellent option for individuals looking to finance a vehicle for business purposes. Whether you're a small business owner or a self-employed professional, a business car loan can help you acquire the vehicle you need to support your business operations.

These loans often come with flexible repayment terms and may offer tax benefits, making them an attractive choice for entrepreneurs.

- Pros: - Ability to finance a vehicle solely for business use - Potential tax benefits - Flexible repayment options tailored to business cash flow - Opportunity to build credit for your business

- Cons: - Limited to business-related vehicle use - May require additional documentation and proof of business ownership

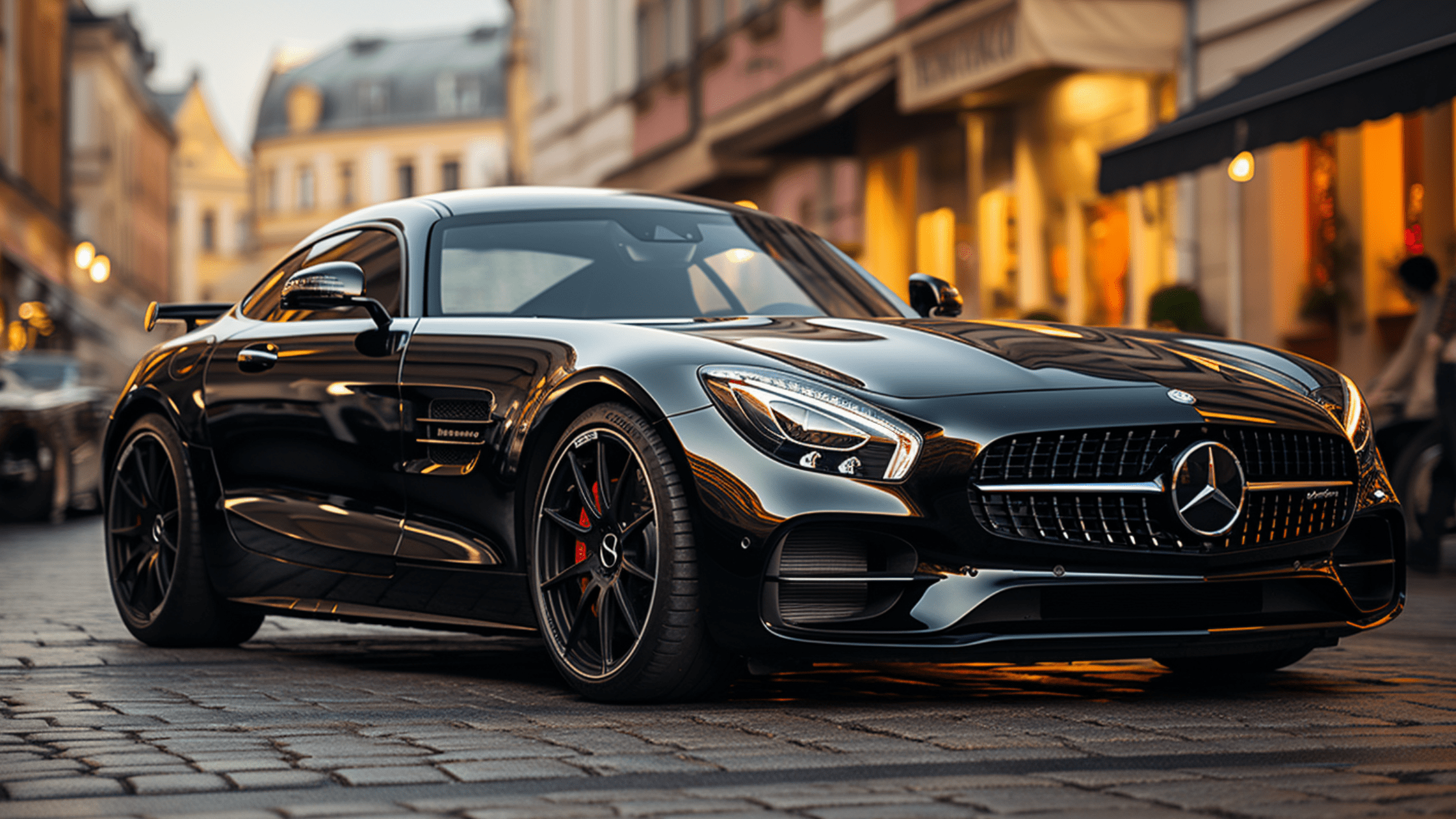

Luxury Car Loans

If you have your sights set on a luxury vehicle, a luxury car loan can help you turn that dream into a reality. These loans are specifically designed for high-end vehicles and often come with competitive interest rates and flexible terms.

However, it's important to consider the higher purchase price and potential depreciation of luxury vehicles when designing your investment plan.

- Pros: - Access to high-end luxury vehicles - Competitive interest rates for luxury car financing - Flexible loan terms to suit your financial situation

- Cons: - Higher purchase price and potential depreciation - Higher insurance and maintenance costs compared to standard vehicles

Electric Car Loans

With the rise of eco-consciousness and advancements in electric vehicle technology, electric car loans have become increasingly popular.

These loans are specifically tailored for purchasing electric vehicles and often come with incentives such as lower interest rates or government subsidies. Investing in an electric car not only benefits the environment but can also result in long-term cost savings due to lower fuel and maintenance expenses.

- Pros: - Lower fuel and maintenance costs compared to traditional vehicles - Potential incentives and subsidies - Reduced environmental impact

- Cons: - Limited charging infrastructure in certain areas - Higher upfront cost compared to conventional vehicles

It's important to carefully consider the potential returns and risks associated with each investment option. Factors such as resale value, market demand, and future technology advancements should be taken into account when designing your investment plan.

Explore Our Personal Car Loans

Maximising Returns on Your Car Loan Investment

When designing your car loan investment, it's important to consider strategies that can help you maximize your returns. By implementing the right tactics, you can make the most of your investment and potentially save money in the long run.

Here are some tips to help you maximize returns on your car loan investment:

Thorough Research and Comparison

Before committing to a car loan, it's crucial to conduct thorough research and comparison. Explore different lenders and loan options to find the most competitive interest rates, loan terms, and repayment options. By comparing multiple offers, you can ensure that you secure the best deal and maximize your potential returns.

Consider utilizing online loan comparison tools, which can provide you with a comprehensive overview of available options. These tools allow you to compare interest rates, loan terms, and associated fees, empowering you to make an informed decision. Remember, even a small difference in interest rates can significantly impact your overall investment returns.

Refinancing Opportunities

Refinancing your car loan can be an effective strategy for maximizing returns. If you find that interest rates have decreased since you initially obtained your car loan, refinancing can allow you to secure a lower interest rate and potentially reduce your monthly payments. This can result in significant savings over the life of the loan.

Additionally, if your credit score has improved since you obtained your car loan, refinancing can help you qualify for better loan terms and potentially lower interest rates. It's important to carefully evaluate the costs and benefits of refinancing, taking into account any associated fees or penalties.

Early Repayment Strategies

Another way to maximize returns on your car loan investment is by implementing early repayment strategies. By paying off your loan ahead of schedule, you can save on interest payments and potentially reduce the overall cost of the loan.

Before pursuing early repayment, it's essential to review your loan agreement and understand any penalties or fees associated with early repayment. Some lenders may charge prepayment penalties, which can offset the potential savings. However, if early repayment is feasible and financially beneficial, it can be a smart strategy for maximizing your returns.

Explore Our Electric Car LoansPersonalizing Your Car Loan Investment Strategy

Designing your car loan investment strategy requires personalization to align with your individual needs and preferences. By tailoring your strategy, you can make informed decisions that support your financial goals. Here are some considerations to help you personalize your car loan investment strategy:

Types of Car Loans

Consider the different types of car loans available and choose the one that suits your specific requirements.

For example:

- Personal Car Loans: If you're purchasing a car for personal use, a personal car loan is a common choice. These loans offer flexibility and can be used to finance both new and used vehicles.

- Ride-Share Car Loans: If you're considering using your car for ride-sharing services, such as Uber or Lyft, a ride-share car loan may be more suitable. These loans often come with specific terms and conditions that cater to ride-share drivers.

By selecting the right type of car loan, you can ensure that your investment aligns with your intended use of the vehicle.

Professional Advice

Seeking professional advice can be invaluable when designing your car loan investment strategy. A financial advisor or loan specialist can provide expert guidance based on your financial situation and goals. They can help you understand the intricacies of different loan options, assess your eligibility, and recommend the most suitable solution.

Additionally, loan comparison tools can be useful in evaluating different loan offers. These tools allow you to input your requirements and preferences, and they provide a list of lenders and loan options that meet your criteria. Utilizing these tools can save you time and effort in researching and comparing loan options.

Considerations for Loan Repayment

When personalizing your car loan investment strategy, consider your preferred loan repayment structure. Some individuals may prefer fixed-rate loans, where the interest rate remains constant throughout the loan term. This provides stability and allows for predictable monthly payments.

Others may opt for variable-rate loans, where the interest rate fluctuates based on market conditions. Variable-rate loans can offer the potential for lower interest rates, but they also carry the risk of rates increasing over time.

It's important to assess your risk tolerance and financial situation when choosing between fixed-rate and variable-rate loans. Consider factors such as your income stability, future interest rate outlook, and overall financial goals.

Start Your Online Car Loan Application NowFAQ's about Designing Investments for Car Loans

We are here to help. Contact us for further assistance or inquiries regarding car loan investments.

What are the eligibility criteria for car loans?

The eligibility criteria for car loans can vary depending on the lender and the type of loan. Generally, lenders consider factors such as your credit score, income, employment history, and debt-to-income ratio. They will also assess the value and condition of the vehicle you intend to purchase. Meeting these criteria demonstrates your ability to repay the loan and reduces the lender's risk.

How can I calculate the affordability of a car loan?

Calculating the affordability of a car loan involves assessing your monthly income, expenses, and other financial obligations. Start by determining how much you can comfortably allocate towards car loan repayments each month without straining your budget. Consider factors such as your existing debt, living expenses, and savings goals. It's important to choose a loan that fits within your budget to avoid financial stress and potential default.

What are the interest rate options for car loans?

The interest rate options for car loans typically include fixed rates and variable rates. A fixed-rate loan has an interest rate that remains constant throughout the loan term, providing stability and predictable monthly payments. On the other hand, a variable-rate loan has an interest rate that can fluctuate based on market conditions. Variable rates may offer the potential for lower interest costs but come with the risk of rates increasing over time.

Can I refinance my existing car loan for better investment opportunities?

Yes, refinancing your existing car loan can be a viable option if you find better investment opportunities. By refinancing, you can potentially secure a lower interest rate or more favorable loan terms, which can lead to cost savings. However, it's important to carefully evaluate the costs and benefits of refinancing, taking into account any associated fees or penalties. Consider the potential savings and how they align with your investment goals.

What documentation is required for a car loan application?

The documentation required for a car loan application typically includes proof of identity, proof of income, and proof of residence. You may need to provide documents such as your driver's license, pay stubs or tax returns, bank statements, and utility bills. Additionally, you may need to provide information about the vehicle you intend to purchase, such as the purchase agreement or vehicle details. The specific documentation requirements may vary depending on the lender.

Can I get a car loan with a low credit score?

While a low credit score can make it more challenging to obtain a car loan, it's still possible to secure financing. Some lenders specialize in providing loans to individuals with less-than-perfect credit. However, loans for borrowers with low credit scores often come with higher interest rates to compensate for the increased risk. It's advisable to work on improving your credit score before applying for a car loan to increase your chances of securing more favorable terms.

Are there penalties for early repayment of car loans?

Some car loans may have penalties for early repayment, known as prepayment penalties. These penalties are designed to compensate the lender for potential interest income that would have been earned if the loan had been repaid according to the original schedule. It's important to review your loan agreement and understand any potential prepayment penalties before considering early repayment. If prepayment penalties exist, evaluate whether the potential savings from early repayment outweigh the associated costs.

How can I compare different car loan options?

Comparing different car loan options involves assessing factors such as interest rates, loan terms, fees, and repayment flexibility. Utilize loan comparison tools, which can provide you with a side-by-side comparison of multiple loan offers. These tools allow you to input your preferences and requirements, and they generate a list of loans that meet your criteria. Additionally, consider seeking professional advice from loan specialists who can provide insights and help you make an informed decision.

What are the benefits of secured car loans?

Secured car loans require collateral, usually the vehicle itself, which reduces the lender's risk. As a result, secured loans often come with lower interest rates compared to unsecured loans. Secured loans also offer the potential for longer repayment terms, which can result in lower monthly payments. However, it's important to consider the risk of repossession if you default on the loan, as the lender has the right to seize the collateral.

How long does the car loan pre-approval process take?

The car loan pre-approval process can vary depending on the lender and your individual circumstances. In some cases, you may receive a pre-approval decision within a few hours or days. The process typically involves submitting an application, providing the required documentation, and undergoing a credit check. It's advisable to gather all necessary documents beforehand to expedite the pre-approval process. Pre-approval gives you an indication of the loan amount you may qualify for, allowing you to shop for a vehicle within your budget with confidence.

Conclusion:

In concluding, Sydney Car Loans stands as your reliable associate in strategizing investments for car loans. We are driven by our profound comprehension of the automotive sector, making us unique. Our alliance with over 20 top lenders allows us to procure the best loan terms for our clients, reflecting our commitment to transparency and honesty.

Our services extend across New South Wales, catering to diverse client needs. Whether it's a personal, business, or luxury car loan you're seeking, we can guide you to the ideal solution, thanks to our extensive array of car loan options. Embodying more than a car loan provider, we are a dedicated partner turning your automotive aspirations into reality.

For any inquiries, our committed team is ready at +61 2 5301 9035, Level 35, Tower 1, 100 Barangaroo Ave, Barangaroo NSW 2000, and https://sydney-carloans.com.au/.

Choose Sydney Car Loans and let us navigate the complexities of car financing for you, making your automotive dreams come true.

).png?width=250&height=141&name=Sydney%20Car%20Loans%20(Presentation%20(169)).png)